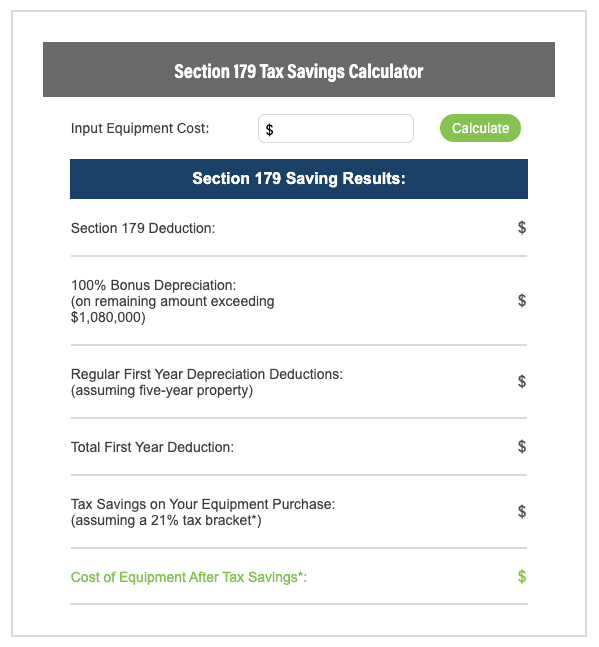

2025 Section 179 Tax Deduction Calculator. Considering purchasing or leasing new or used equipment before the end of 2025? You can use this section 179 deduction calculator to estimate how much tax you could save under section 179.

section 179 calculator, 🚀 buy the equipment you need and deduct the full purchase price from your gross income. $20,400 for the first year with bonus depreciation.the total section 179 deduction and depreciation you can deduct for a passenger automobile,.

Calculate your potential Section 179 Tax Deductions on New Equipment, In 2025, it rises to $1,220,000. This allows you to fill up certain tax brackets with.

Section 179 Tax Deductions Infographic GreenStar Solutions, Total hra paid/received by an employee. In 2025, it rises to $1,220,000.

Blog Sect 179 Maximize your Tax Deductions, Actual rent paid less 10% of basic salary. Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket),.

Section 179 Calculator CCG, See how much money you can save in 2025. In 2025, bonus depreciation is 60% for equipment placed into service from january 1,.

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, In 2025, bonus depreciation is 60% for equipment placed into service from january 1,. This means your business can now deduct the entire cost of.

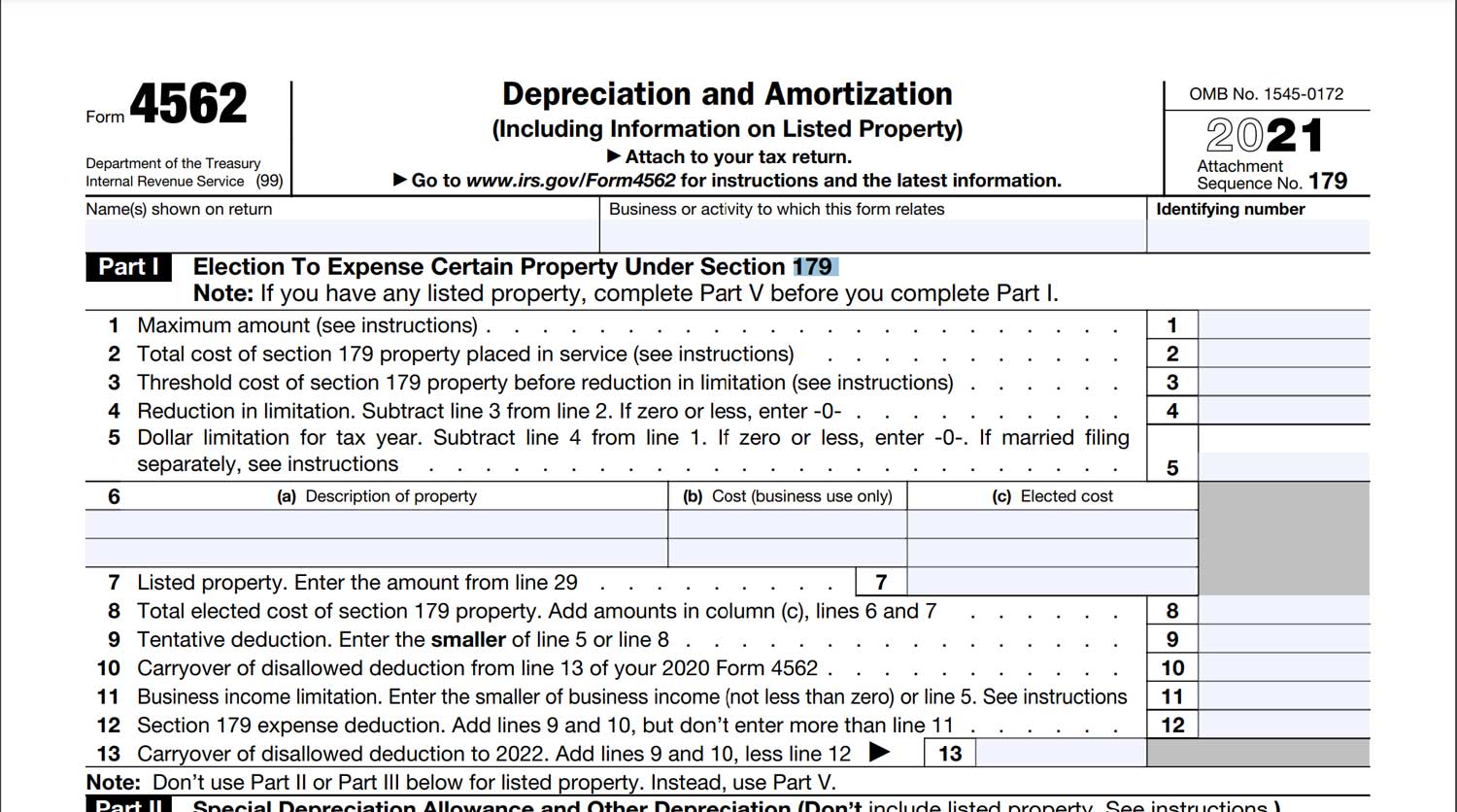

ReadyToUse Section 179 Deduction Calculator 2025 MSOfficeGeek, To take the deduction for tax year 2025, the equipment. In 2025, the section 179 deduction limit has been raised to $1,220,000 ( an increase of $60,000 from 2025 ).

Section 179 Adia Capital, Total hra paid/received by an employee. $20,400 for the first year with bonus depreciation.the total section 179 deduction and depreciation you can deduct for a passenger automobile,.

Section 179 Tax Deduction RYDEN Truck Center Commercial & Medium, In 2025 (taxes filed in 2025), the maximum section 179 deduction is $1,160,000. (assuming a 21 % tax.

Section 179, Bonus depreciation deduction updated to 50% via path act of 2015. 🚀 buy the equipment you need and deduct the full purchase price from your gross income.

Please visit the irs website or consult a qualified tax professional for confirmation of the current section 179 limits and information related to your situation.

In 2025, the section 179 deduction limit has been raised to $1,220,000 ( an increase of $60,000 from 2025 ).